I hope you have a good Christmas, if you’re celebrating today. We’re with my parents in York, as usual, and planning a relatively quiet and relaxed break after an eventful year.

Please enjoy this AI-generated image of a Merry Crisp-Mouse.

Technology and randomness, since 2002

I hope you have a good Christmas, if you’re celebrating today. We’re with my parents in York, as usual, and planning a relatively quiet and relaxed break after an eventful year.

Please enjoy this AI-generated image of a Merry Crisp-Mouse.

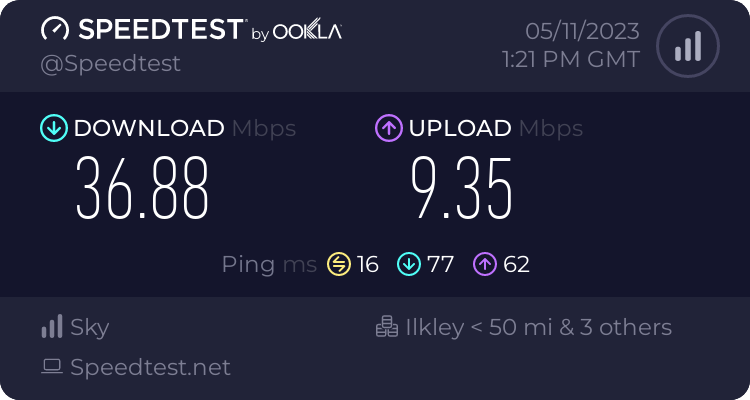

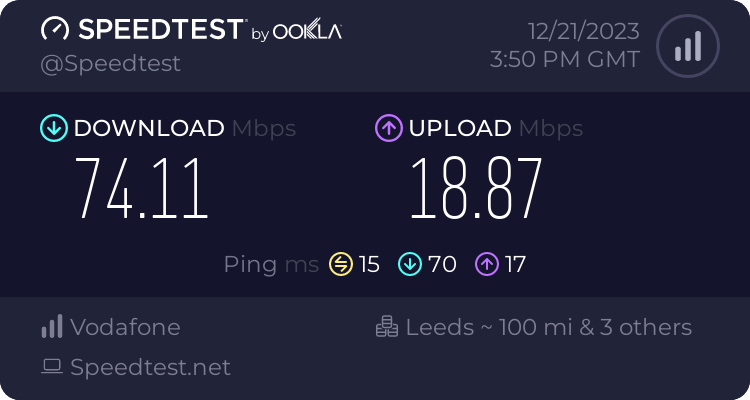

Last month, we switched to Vodafone as our new Internet Service Provider (ISP) at home.

We’ve been with Now Broadband (Sky’s budget brand) since autumn 2018, who, at the time, could offer us faster speeds for less money. And they’ve been pretty good; when I was working at home full-time during lockdown, I rarely had any issues. Our bandwidth was sufficient for me to participate in online meetings whilst our (then) four-year-old watched Netflix in another room. Our typical download speeds were in the 35-40 Mbps:

But then Now raised their prices by £9 per month. They probably told us that they would do this, but I have no recollection of being informed in advance.

Meanwhile, Vodafone could offer faster speeds and a new router, for £2 less than Now before the price rise. So, we would be getting a better service, and paying £11 less per month for it than if we stayed with Now.

We used the MoneySavingExpert broadband comparison tool, which showed that Vodafone was the cheapest big name that didn’t have a poor customer service rating. Shell Energy were cheaper, but their customer service isn’t great and they’ve just been taken over by Octopus Energy who don’t currently offer broadband.

I signed up using Quidco (referral link) and should get £82.50 cashback in late spring, so factoring that in, what a savings.

The switchover took a couple of hours, and seemed to happen early in the morning, so by 7am we were already online with Vodafone. And the speeds are much better – around 75 Mbps download and 19 Mbps upload, so almost twice as fast. Considering that this is over DSL, I’m impressed with how fast it is.

The new Vodafone broadband hub is also better than the basic Now broadband router that we had previously. It has four 1 Gbps Ethernet sockets for a start, compared to just two on the Now router; this means I no longer need a separate Ethernet switch. It also looks nicer; it’s free-standing but has mounting holes on the back for screws.

The hub also supports Digital Voice Line, where your phone calls are made over the internet, rather than PSTN. Openreach intend to switch off the analogue phone network in two years time, so switching now is timely. This means that our landline phone plugs into the hub, rather than the micro-filter attached to the master phone socket. That being said, since the switchover, our phone hasn’t actually worked. The fact that it took me several days to realise shows how much we use our landline, but I’ll need to get on to Vodafone to have them look into it.

As with all changes to a new ISP, over the first few weeks there was a little instability with the connection. But it’s settled down now and works well. The other issue I had early on was with connecting to my Raspberry Pi externally, as port forwarding didn’t seem to work properly. This was a bit of a gut punch, considering how much effort it took me to get Home Assistant working with HTTPS, but it seems to be sorted now.

If it’s been a while since you switched your ISP, I would recommend that you do a quick check to see if you can get a better deal elsewhere. Broadband providers make a lot of money from people who just let their contracts auto-renew. Even if you’re happy with your current ISP, you could try haggling with them to see if they can offer you a cheaper package.

When I started blogging regularly again in October, I planned to post a new blog post every other day (so, 3-4 new blog posts every week). As this is the first time I’ve posted since the 10th December, about my hearing aids, I’ve not managed to meet my own target.

In years gone by, I would publish multiple blog posts every day – but this was in the days before the likes of Twitter and Facebook. Indeed, Twitter used to be known as a ‘micro-blogging’ service in its early days. Consequently, Twitter became the place where I would post any thoughts that could be condensed into 140 characters would go.

I then had a few months where I aimed to publish one new blog post every day. Not write a post every day – I would write several at a time and then publish them to a schedule. But that petered out after a while; all it takes is for a busy period at work, or a couple of weekends where we’re away or have plans, and it becomes hard to keep up. And you end up with apologetic blog posts like this one.

Of course, I then didn’t post anything for years, until last year, so there’s that.

The good news is that today I finished work for Christmas, and so I have some time to queue up some new blog posts. I have a list of blog post ideas to work through; it turns out taking several years out from blogging means I have plenty to write about. You’ll start to see some of these appearing every other day over the next few weeks.

The featured image on this post is AI-generated; for diversity, I specified a Muslim woman rather than just ‘a person’, because there are enough images of white men in the world.

Last month, I wrote about how I started wearing glasses in the summer of 2021. And, as if there was any further indication that I’m getting older, I wear hearing aids now too.

I’ve been aware that my hearing has been getting worse for some time, and a hearing test four years ago suggested that I may need an intervention. At the time, my GP wasn’t too concerned, and then the Covid-19 pandemic happened which meant that any work interactions were through a pair of headphones anyway.

But as we started returning to the office, it was clear that my hearing was still an issue. Another hearing test confirmed this, and so another GP referral. This took several months to sort out, and finally in early autumn 2022 I had a follow up appointment with audiology and ENT at one of our local hospitals. I was given the option of having surgery, or hearing aids.

Surgery may have made a greater difference, but I was concerned about the recovery times and how likely this would make a difference in the short term. So, I opted to have hearing aids, and I had them fitted in October 2022.

The hearing aids I have are very basic, NHS standard issue behind-the-ear models, manufactured by Oticon. This means that the electronics are in a small metal container which sits behind your ear, and then a plastic tube connects to a moulded earpiece that sits in your outer ear. The earpieces are moulded specially for each ear, so that they’re comfortable enough to wear all day.

As they are very basic hearing aids, there’s no Bluetooth support, so I need to take them out to listen out to music. Whilst Bluetooth hearing loop devices exist, they’re expensive (as they’re classed as medical devices) and the sound quality apparently isn’t great. In terms of controls, I can adjust the volume on the hearing aids, and switch them in and out of hearing loop mode, but that’s all. You turn them off by opening the battery compartment. They take small button batteries which aren’t rechargeable, but each battery typically lasts 10-14 days.

The hearing aids made a massive difference from day one. My wife no longer has to shout at me to get my attention, and I can hear colleagues across our large open plan office at work. In the car, I can have the stereo at a much lower volume too. The only downsides are:

Having in-ear hearing aids with Bluetooth would mitigate these issues, but I would have to buy them privately. And they can cost a fortune – a colleague of my wife spent several thousand pounds on hers. Meanwhile, mine are free on the NHS, and even the replacement batteries are free. Maybe if I come into a large amount of money in future, I’ll consider some buying some more advanced hearing aids privately.

Whilst with the audiologist at one of my check-ups, I noticed a poster about the link between hearing loss and dementia. We don’t fully understand why people with hearing loss are more likely to develop dementia, but one theory is that such people ‘tune out’ if they can’t hear. I’m hoping that using my hearing aids and having regular hearing checks will reduce my risk of developing dementia in later life.

If you can’t remember the last time that you had a hearing test, I recommend getting one. Most branches of Specsavers now offer audiology services as well as optics, and they can do a GP referral if they have concerns.

You may have noticed that several of my recent blog posts have featured custom AI art work related to the topic. I’ve generated these using Microsoft’s Bing AI Image Creator, which uses OpenAI’s DALL-E text-to-image model. DALL-E can generate an image based on a text prompt; for example, the featured image on this post was ‘A 1950s style robot standing in front of an easel painting a bouquet of flowers in a vase’.

These are some of the other AI art images that I’ve used recently:

AI art is controversial. It can create images in a few seconds that would take a human artist hours or days to produce. And, in some cases, these image prompts can be told to create images in the style of a particular artist, depriving them of income from a commission. It’s also notable that models like DALL-E and Stable Diffusion have been trained on copyright works, without the rights holders’ permission.

With this in mind, I’m justifying my use of AI art on some of my blog posts because I’m not an artist myself, and as an individual blogger who doesn’t make money from blogging, I wouldn’t have the money to pay a human artist. Whilst I have over 5000 photos that I’ve uploaded to Flickr, there isn’t always a relevant photo to use that I have taken. For example, in my recent post on comment spam, I decided to generate the above image of a robot converting blog posts into a tinned meat product, because I don’t have a photo that represents that. And whilst I make use of screenshots where relevant, sometimes this isn’t appropriate.

Of the AI art generators that I have used, the Bing AI Image Creator seems to be the one that gives me the best results. Any images you create are saved in the cloud, and can be downloaded for re-use. And each prompt produces four images so that you can choose the one which looks the best.

I’m gradually bringing back some of my old blog posts that were lost, and here are links to the latest batch that I’ve made live again:

There are, of course, more to come. Whilst I estimate that I’ll only be bringing back around 10% of the old blog posts, that does mean around 250 posts to copy from the Web Archive and update.

When you need to buy a present for someone, and aren’t sure what to get them, gift cards seem like a good idea. With Christmas coming up, I’m going to explain why they’re not always the best idea.

If you spend £10 to buy a £10 gift card, all you have done is taken £10 of cash, which can be spent anywhere, and converted it into a sort of pseudo-currency that can only be used at one shop. You can’t use a gift voucher for John Lewis at M&S for example.

Whilst multi-retailer gift cards like Love2Shop and One4All exist, they still limit you to a small range of retailers. And you can usually only spend them at large chain stores, so your recipient won’t be able to spend them at a local, independent shops. Let’s face it, Amazon is likely to be around for a long time, but independent shops would probably appreciate your custom.

This might seem obvious, but you can only use gift cards to buy more things. You can’t use gift cards to pay bills, or repay debt, for example. And I mean, you really can’t – if someone claims to be HM Revenue & Customs and asks you to pay your tax bill with iTunes Gift Cards, then it’s a scam.

For someone who may be drowning in credit card debt, receiving some money that they can use to pay that off may be more meaningful. At worst, you could end up spending your money on a gift card that can only be used to buy something at a shop where the cost of getting there is higher than the value of the card.

They could also be worthless. If you’re an Android phone user, then you’re not going to get much out of an iTunes gift card, for example. You could try a web site that exchanges gift cards, where you can sell an unwanted gift card for cash. However, you’ll probably get less than its value back, and obscure gift cards may not sell for much.

Most gift cards expire after 12 months. We’ve had this problem before; a relative bought our (now) seven-year-old a gift card for a well-known toy shop chain. As their birthday is close to Christmas, we saved it to buy a gift the following year, but by the time we came to use it, it had expired. Meanwhile, cash never expires.

We’ve recently seen the demise of Wilko in the UK, and other large chain stores like Debenhams, Jessops, Comet, Woolworths, Burtons have all disappeared in recent years. Usually, when these companies go bankrupt and call in administrators, their gift cards immediately become worthless. At best, you can sign up as a creditor of the company in the hope that you may get a fraction of the value of the gift card back.

Some people have lost serious money because of this in the past. Debenhams used to offer a wedding list service, and so those that had people buy them Debenhams gift cards as wedding presents may have lost out on hundreds of pounds.

Buying presents can be tricky, and I don’t think anyone wants to buy something that’ll just end up listed on eBay on Boxing Day. But maybe have a conversation with the person who you are buying a gift for first. Surprises can be nice, but so can knowing that you’re getting a thing that you actually want for Christmas. Christmas lists for Santa needn’t just be for children; you could keep a list in a note-taking app, for example, so that if anyone asks you what you want, you can tell them straight-away.

Or you could just give people cash. If all you are doing is swapping the same amount of money for a card which is restricted to one retailer and expires, then you’re taking choice away from your recipient. With cash, your recipient could use that money for:

An Amazon gift card won’t allow the recipient to do any of those things.

If you don’t want to put bank notes or coins in the post, you can send a cheque. Despite rumblings from the banking industry a few years ago, most banks will still let you send and receive cheques. Indeed, most banking apps will let you scan cheques, so you can scan them on Christmas Day without waiting for a branch to open. Alternatively, you could send an IOU in a card, and then do a BACS transfer on Christmas Day. That’s if you already know their bank details, of course.

So, now that I have written this, you may be surprised to hear that I am planning to send gift cards to some relatives this Christmas. But this is only because said relatives have specifically asked for them. And that’s fine – you could ask for gift cards as a contribution to a big purchase, for example. Just be careful that you choose a retailer that isn’t at imminent risk of bankruptcy. Money Saving Expert News is usually a good place to get news about retailers that are, or are at risk of entering administration, and their policy on accepting gift cards.

You can also sometimes buy gift cards at a discount. My employer offers Pluxee as an employee benefit, which sells gift cards at a typical 4% discount – but sometimes more. M&S is 6.5%, which means that you can buy a £25 gift card for £23.38.

If your employer doesn’t offer something similar, but you have a mortgage, then Sprive is worth considering. With Sprive, the discounts are smaller (about 3%) but the money you save is taken off your mortgage. If you decide to sign up to Sprive, use my referral code ‘HTWH65PM’ to get an additional £5 off your mortgage.

If you’re buying Amazon gift cards, it’s worth checking your personalised promotions page (sponsored link). Sometimes, Amazon offers additional discounts available if you buy gift cards in bulk.

Christmas Day is three weeks today. If you haven’t already finished your Christmas shopping, maybe reach out to your gift recipients to find out what they want. Just be aware of the last posting days for gifts.

As you’ll be aware from my regular posts about it, I have a Raspberry Pi 4 running Ubuntu Core, which acts as a server for Home Assistant, Plex and Calibre-Web. Here’s how I’ve set it up to mount an external USB hard drive on boot up.

As it’s a Raspberry Pi, the operating system and binaries set on a microSD card, which in this case is a mere 16 GB. Whilst the me of 20 years ago would have been astounded at the concept of something so tiny holding so much data, 16 GB isn’t much nowadays. So, I have a 1 TB external USB hard drive for storing the media files for Plex and Calibre-Web.

Ubuntu Core doesn’t automatically mount USB storage devices on startup unless you tell it to, and the instructions for doing so are different when compared with a regular Linux distro.

Most Linux distros, including regular Ubuntu, include fstab for managing file systems and mounting devices. But Ubuntu Core is designed to be a lightweight distro to act as firmware for Internet of Things devices, and so it doesn’t include many tools that are common in other Linux distros. fstab is one such tool which is missing.

You can, of course, just mount a USB drive manually with the following:

sudo mkdir /media/data

sudo mount /dev/sda1 /media/data

But this won’t persist when the computer restarts. After a bit of searching, I found a solution on StackExchange; it’s for Ubuntu Core 16, but works on 22 as well.

It should go without saying that you should back up your system before doing any of this. If you make a mistake and systemd stops working, your device could become unbootable.

Firstly, you’ll need to run sudo blkid to list all of the file systems that Ubuntu Core can see. Find the one that starts with ‘/dev/sda1’ and make a note of the long hexadecimal string that comes after UUID – it’ll probably look something like ‘2435ba65-f000-234244ac’. Copy and save this, as this identifies your USB hard drive.

Next, you’ll need to create a text file. Ubuntu Core only seems to offer the Vi text editor, which I haven’t bothered to learn to use properly. My favoured text editor is nano, but it’s not available on Ubuntu Core. Therefore, my recommendation is to create a file on another device and FTP it across. The file should be called media-data.mount; it’s really important the file name matches the intended mount point. For example, if you’re instead planning to mount the USB hard drive to /mnt/files, this text file would need to be called mnt-files.mount.

Here’s the template for the file:

[Unit]

Description=Mount unit for data

[Mount]

What=/dev/disk/by-uuid/[Your UUID]

Where=/media/data

Type=ext4

[Install]

WantedBy=multi-user.targetYou’ll need to paste in the UUID for your USB hard drive where it says ‘[Your UUID]’. You’ll also need to match the file system type; I have my external USB hard drive formatted as ext4 for maximum compatibility with Linux, but yours may use ExFAT or NTFS.

This file needs to be saved to /etc/systemd/system/media-data.mount . You can either use vi to create and save this file directly or FTP it across and copy it over.

There are three further commands to run in turn:

sudo systemctl daemon-reload

sudo systemctl start media-data.mount

sudo systemctl enable media-data.mount

If you’ve done this correctly, then the next time you restart your device, your USB hard drive should mount automatically. If not, then you should receive some surprisingly helpful error messages explaining what you’ve done wrong.

There’s another guide at Wimpy’s World which has some additional detail and helped me get this working.

Now that I’m blogging regularly again, I’ve decided to start a new monthly feature where I post a playlist of 10 songs, all around a theme. With a few hours to go until the end of the month, here’s this month’s playlist.

These songs are all indie rock songs with a big guitar riffs, and are some of my favourite songs. If you want to listen along, here’s the Spotify playlist.

I’ll do another playlist of 10 songs next month. With it being December, no prizes for guessing the theme.

Something that I’ve become more concerned about in our household is our consumption of so-called ‘ultra-processed food’. My wife has had a few health issues over the past 18 months, including an elevated risk of developing type two diabetes which has seen her cut her sugar intake. But this coincided with the publishing of several books related to ultra-processed food, and has seen us made some changes to reduce our exposure to them.

Before I go into much detail, here are the books I’m talking about:

Note: these are sponsored links, but feel free to purchase these books from your local independent tax-paying bookshop, or borrow them from a library.

If you only read one of these, read Chris van Tulleken’s Ultra-Processed People. Chris is probably better known as ‘Dr Chris’ from the CBBC show Operation Ouch, which he presents with his twin brother Dr Xand (and later Dr Ronx). He’s a triple-threat: a GP who is also a research scientist and a TV presenter, and it shows. He’s able to digest some academic research into an easily readable format, which isn’t surprising when you consider that this is what he does for his patients and his TV audience. But it also means that there’s academic rigour behind this book.

Dr Xand pops up quite a bit in this book; Chris and Xand are identical twins but have different physiques. Chris puts this down to Xand’s time in the USA, where he was exposed to higher amounts of so-called ‘ultra-processed food’, and so he’s ended up higher on the BMI scale than his brother (although Chris acknowledges that BMI is discredited). When they both contracted Covid-19 in 2020, Xand was more seriously ill than Chris.

Over the course of the book, we discover that there’s increasing evidence that ultra-processed food is linked to obesity, and how the food industry tries to downplay it.

Chris acknowledges that it can be hard to define what ultra-processed food is. The best model that we have is the Nova classification, developed by Prof Carlos Augusto Monteiro at the University of Sao Paulo in Brazil. Essentially, this splits food into 4 groups:

Probably the easiest way to work out if something fits into the Nova 4 category is by looking at the list of ingredients. If there are one or more ingredients listed that you can’t expect to find at a typical large supermarket, then it’s probably ultra-processed food. Things like emulsifiers, artificial sweeteners, preservatives and ingredients identified only using those dreaded E numbers that my mum used to be wary of back in the 1980s.

And there’s a lot of food that fall into the Nova 4 category. Almost all breakfast cereals, and any bread that is made in a factory, are examples.

Fundamentally it’s to do with cost and distribution. For example, a tin of tomatoes that contains some additional ultra-processed ingredients may be cheaper than a tin just containing tomatoes (and perhaps a small amount of acidity regulator). It’s a bit like how drug dealers cut drugs with, for example, flour, to make more money when selling their drugs on.

Distribution is also a factor. A loaf of bread that is baked in a factory may take a couple of days to reach supermarket shelves, where it also needs to be ‘fresh’ for a few days. So the manufacturers will add various preservatives and ingredients to ensure that bread remains soft.

You can bake your own bread using only yeast, flour, salt, olive oil and water. But Tesco will sell you a loaf of Hovis white bread that also contains ‘Soya Flour, Preservative: E282, Emulsifiers: E477e, E471, E481, Rapeseed Oil, and Flour Treatment Agent: Ascorbic Acid’. These are to keep the bread soft and extend its shelf life, as a homemade loaf may start going stale after 2-3 days. This means that a shop-bought loaf may go mouldy before it goes stale.

Breakfast cereals brand themselves as a healthy start to the day, but often contain worryingly-high amounts of sugar. And there’s evidence that their over-use of ultra-processed ingredients interferes with the body’s ability to regulate appetite, leading to over-eating.

Ice cream is also often ultra-processed, if you buy it in a supermarket. The extra additives ensure that it can survive being stored at varying temperatures whilst in transit. It’s notable that most UK ice cream is manufactured by just two companies – Froneri (Nestlé, Cadbury’s, Kelly’s, Häagen-Dasz and Mövenpick brands) and Unilever (Walls and Ben & Jerry’s). There are many small ice cream producers, but the challenge of transporting ice cream and keeping it at the right temperature means that they have limited reach.

I’m also worried about a lot of newer ‘plant-based’ foods that are designed to have the same taste and texture as meat and dairy products. You can eat a very healthy plant-based diet, but I would argue that some ultra-processed plant-based foods would be less healthy that the meat and dairy products that they’re mimicking.

We now bake our own bread in a bread machine. Not only do you avoid ultra-processed ingredients, but freshly-baked bread tastes so much nicer than a loaf bought in a shop. It takes a little more planning, but most of the ingredients don’t need to be kept fresh.

We also buy more premium products where we can. Rather than refined vegetable oils, we buy cold-pressed oil for frying, and I’ve mentioned chopped tomatoes above. Of course, these products cost more, and it’s something that both Chris and Henry mention in their books. It should come as no surprise that there’s a link between obesity and poverty, if people on low incomes cannot afford good food.

And we’ve had to give up Pringles. Chris devotes practically a whole chapter to them, and how they trick the brain into wanting more.

You can download the Open Food Facts app to help decipher food labels. It includes a barcode scanner, and will warn you if what you’ve scanned is ultra-processed food. The good news is that there are still plenty of convenience foods which are not ultra-processed – there’s some suggestions in this Guardian article.

Whilst I haven’t yet given up on artificially-sweetened soft drinks, we reckon that we’ve cut our sugar intake and our exposure to artificial additives. In many cases, we don’t know the long-term health effects of these additives, although we do know that some people struggle to lose weight despite eating a supposedly ‘healthy’ diet and exercising regularly.