If you’re lucky enough to own your own home, and are paying off a mortgage on it, then you may want to consider signing up to Sprive.

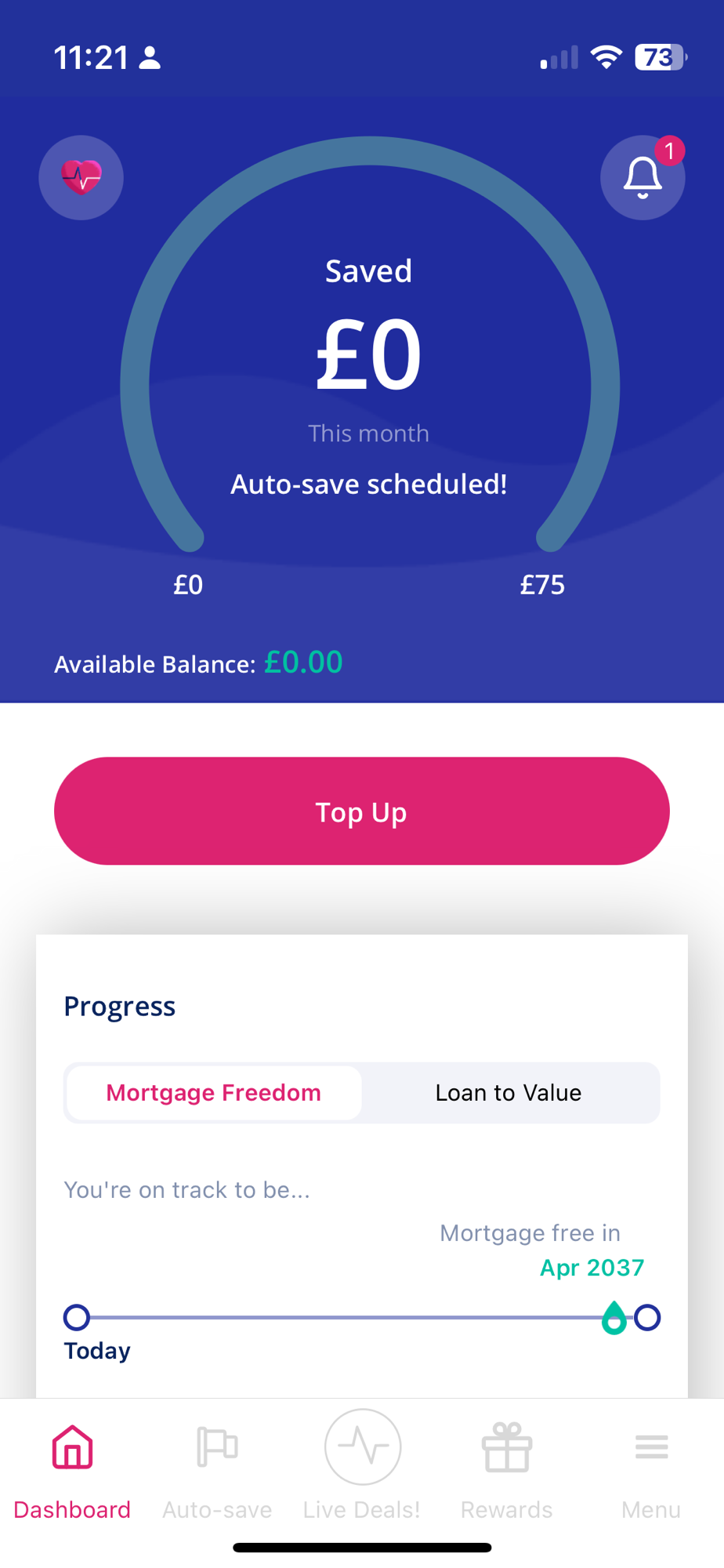

Sprive is an app for iOS and Android, that lets you easily make over-payments on your mortgage. Once you’ve registered, it’ll ask to link to your bank account using Open Banking, and you can then set a minimum and maximum amount to over-pay each month.

The minimum payment can go out on a date that you set, and then Sprive will monitor your current account balance and suggest further payments if you have sufficient money left. Sprive normally gives you a notification a few days before it talks a payment and they’re easy to cancel.

I’m using the absolute minimum amounts – £25 per month, and a maximum of £75 per month. However, even such small additional contributions should mean that we pay off our mortgage earlier. The Sprive app visualises this, and reckons we’re on track to be mortgage-free about 18 months earlier than we would be without over-payments. That translates to around £2000 less interest that we would have to pay otherwise. It’ll also show you what loan-to-value rate you are eligible for, and how much of your house you own. Having bought our house not quite 9 years ago, we now own 55% of it, although this is more due to the house increasing in value rather than our repayments.

Sprive Rewards

As well as siphoning off money from your bank account, there’s Sprive Rewards. This allows you to buy gift cards for many retailers (including all the major supermarkets) where a percentage is then used as a mortgage over-payment. For example, you could buy a £50 Tesco gift card, and have 3% (£1.50) used as an over-payment. You can, of course, use these gift cards for your own shopping, so whilst the savings may not seem like much, they can add up. You can even save 1% with Amazon; when I spent £75 there recently, that 75p has the potential to save me as much as £16 down the line in mortgage interest. I’m not a fan of gift cards, but this is where they can be used to save money.

MoneySavingExpert has a useful mortgage overpayment guide, including what you need to bear in mind. Most mortgage providers do let you overpay up to 10% of your mortgage each year, but it’s worth checking your paperwork. If you over-pay too much, you may pay a penalty for doing so.

If you like what you’ve read, and want to sign up to Sprive, you can use my referral code which is HTWH65PM. This will give you an additional £5 head start – so it’s basically free money, albeit not much and only redeemable as an over-payment on your mortgage.