I’m a couple of days late writing this, but Friday marked 10 years since we got the keys for our house. In that time, we’ve done a lot of work to it:

- Renovated the entire downstairs, including a new kitchen in 2022

- New central heating boiler and new radiators downstairs

- Complete re-wiring downstairs

- Removal of old gas fires and associated gas pipes

- Opened up the cellar to use as a laundry room

- Renovated our nine-year-old’s bedroom with new plaster, floorboards and furniture

- Re-decorated the bathroom

- Added solar panels and a battery

Despite this, the house is still a work in progress. Although we have redecorated the bathroom, and made some minor changes (new taps, new bath panel, replacement shower and shower screen), we’re planning on renovating it once money allows. In particular, at present we have a shower over the bath, but would prefer a separate shower cubicle. After that, there are also our bedroom and our spare bedroom that need renovating, and the landing. But we’ve done more than half of the house now and it’s much nicer for it.

This also means that I’ve had the same address for 10 years – my longest period of stability since moving out of my parents’ home in York, back in 2002. Another eight (and a bit) years, and this will have been the place that I have lived the longest. I’ve already spent more time living in Sowerby Bridge (15 years this November) than Bradford (8 years).

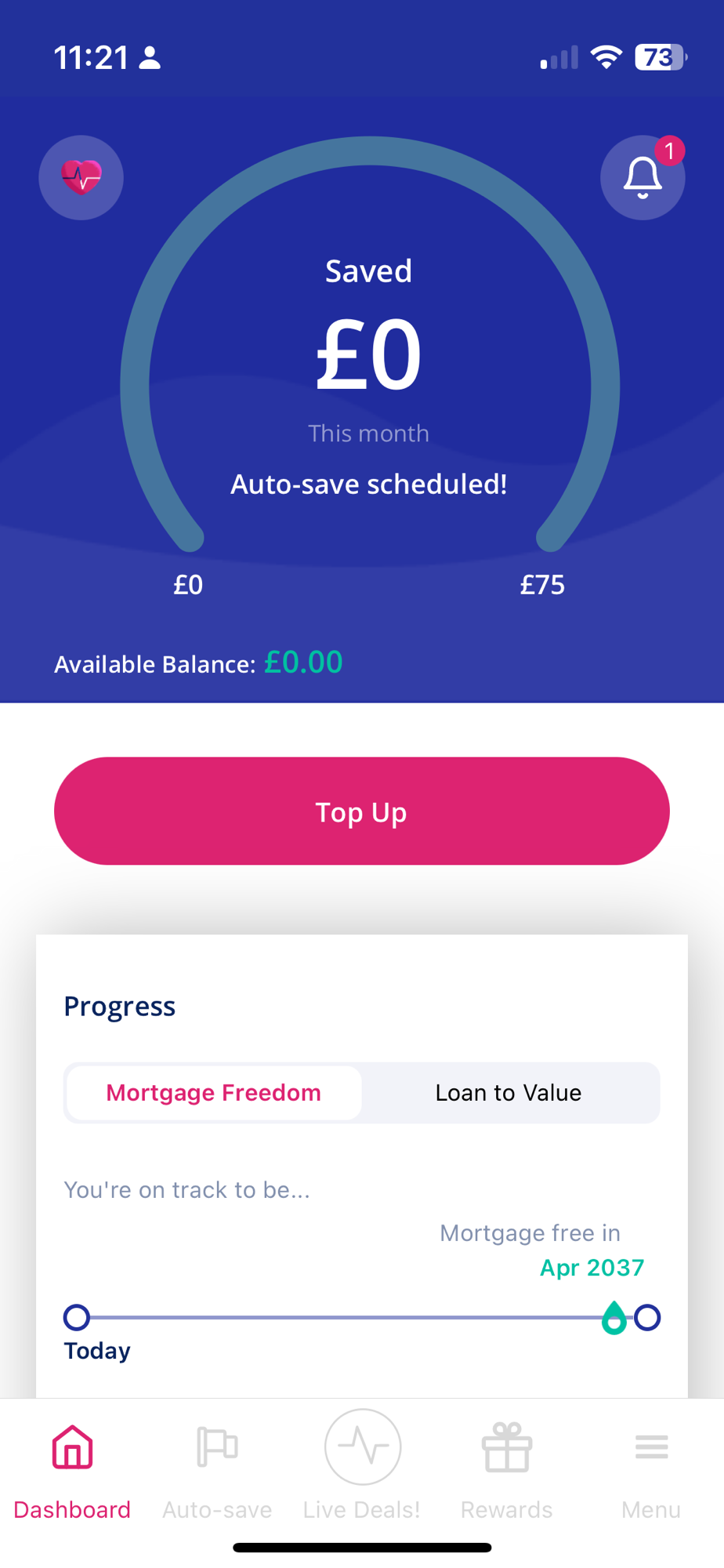

We originally took out a 25 year mortgage in 2015. However, we’ve re-mortgaged a couple of times, most recently in 2022 when we took out a five year fixed deal shortly before the Truss-Kwarteng Fiscal Collapse. And changes to our payments, plus our over-payments via Sprive, should mean that next summer will be the mid-point of our mortgage repayments. So we’ve got a way to go before we’re mortgage free.