Back in December 2023, I wrote about why you shouldn’t give gift cards as presents in the run-up to Christmas. I still stand by that, but wanted to expand on the last section of that post about when it is appropriate to buy gift cards. Because, it turns out, buying gift cards can actually save you money.

This is all about exploiting the difference between the actual cost of gift cards, and their value. Go to any supermarket, and there’s usually a display at the end of an aisle full of gift cards for various other shops, restaurants, cinema chains, subscription services and the like. When you buy one of those cards, a small percentage of what you pay goes to the shop (otherwise they’d be selling them at cost price). To give an example, when you buy a £10 gift card, 50p of that £10 may be kept by the shop, and the gift card supplier gets £9.50.

What we can therefore do is find places that, instead of pocketing that 50p, they pass some of that on to you as a saving. It’s a bit like cashback sites like Quidco (referral link), where they share some of the money they get as commission with you. I’ve listed a few options below:

Pluxee and other employer schemes

I work for an employer who is signed up to Pluxee. This means that I can buy online gift cards, usually at a 3-5% discount, for many stores. The ‘big four’ supermarkets are included, as are the likes of M&S, Boots, and many online retailers. It also handily keeps track of how much money I’ve saved – we’ve had it for close to ten years now and collectively I’ve saved over £100.

You can use it for big ticket items – back in 2020, I bought our LG TV mostly using Curry’s vouchers. At the time, the discount was 8% (I think) and at present it’s 6%. Ultimately it knocked around £25 off the cost of the TV.

The big advantage of Pluxee is that you can buy the gift cards and be able to use them almost straight-away. So, say you’re in a supermarket, and you’ve used one of those handheld scan and ship gizmos, so that you know exactly how much your shopping will cost. You can then quickly buy a gift card for that amount, go to the checkout, and use it to pay for your shopping.

Costco

Another place to buy gift cards at a discount is Costco (something I didn’t mention in my overview last year). As with most things from Costco, you have to buy in bulk. For example, you can buy five £20 Pizza Express gift cards, collectively worth £100, for £85 – that’s a 15% discount, and better than the 7% I get with Pluxee. You can buy the cards both in-store and online, and the online prices include postage.

Bear in mind that these are physical gift cards, and so you will need to actually buy them from the shop, or wait for them to come in the post. You can’t just buy one whilst waiting for your bill in a restaurant, for example. And you’ll need to be a Costco member to take advantage.

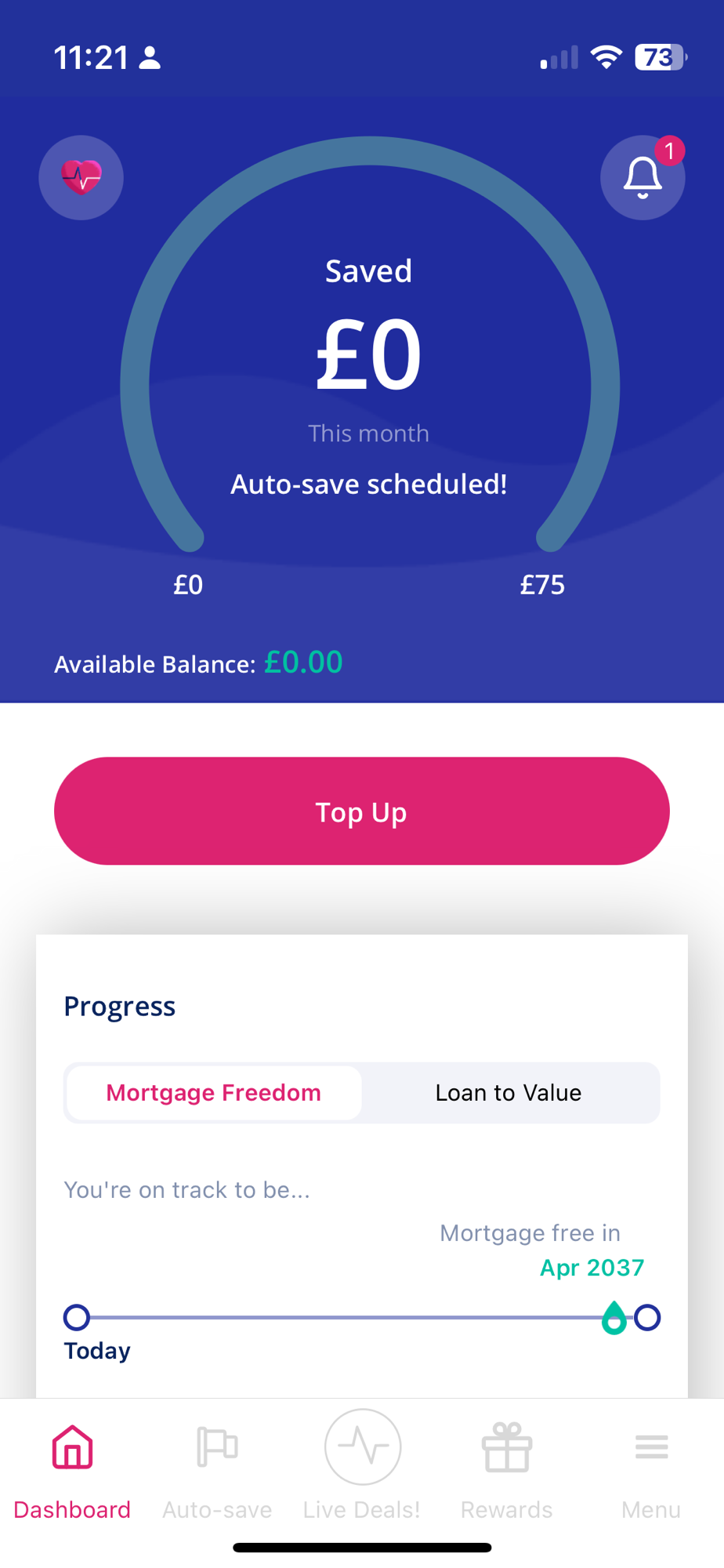

Sprive

I did a more detailed overview of Sprive last April. Sprive is an app for managing mortgage over-payments, but it includes a feature called Sprive Rewards for buying gift cards. It works in a similar way to Pluxee, except that the discount goes towards over-paying your mortgage. So, for example, if you buy a £10 M&S voucher through Sprive, it’ll still cost you £10, but Sprive will add another 40p onto your next mortgage over-payment for you.

The discount rates on Sprive tend to be lower than other apps – most supermarkets are only 2.5% for example. But it’s also the only place I’ve seen that offers Amazon gift cards, albeit at only 1%. However, one could argue that, because the savings are taken off your mortgage, you’ll save more in the long run due to lower interest payments.

If you do decide to sign up to Sprive, use my referral code HTWH65PM for an additional £5 off your mortgage. Incidentally, in the year since I originally wrote about Sprive, we now own 63% of our home, up from 55%.

Obviously, Sprive is only of use if you have a mortgage, Pluxee is only available to people who work for certain employers, and Costco also requires a membership. So, for everyone else, there’s Snip:

Snip

If none of the above options are available for you, then you may wish to consider Snip. I haven’t used it myself, but it allows you to buy gift cards in a similar way to Pluxee. The catch is that there is a monthly (£3) or annual (£30) membership fee. Now, if you use Snip regularly, you will easily save more than the monthly membership fee – assuming that a typical supermarket gift card has a discount rate of 4%, then one £75 shop per month would be enough to cover the fee.

Whilst savings of 3-5% may not seem like much, they do add up over time. This is why I like the tracker on Pluxee – saving a few pence here and there may not seem like much, but over the course of a year, it’s enough to pay for a trip to a cinema and a restaurant (which you could probably also pay for with gift cards). I will admit that it’s also a bit of a faff – I remember spending ages at a self-checkout in Ikea trying to get a voucher for 5% off, and struggling to get the payment to go through. It would be nice if things were just cheaper, rather than having to use workarounds like these.